It's so hard to wait to file your income tax return, especially if you know you're getting a hefty refund. And you've got your December Leave and Earnings Statement (LES,) so why should you wait?

There are three good reasons you should wait for your proper W-2 to be released before you file your income tax return: it's the law, it decreases the chances of having to file an amended return, and it doesn't hurry up your refund anyway.

It's The Law

The IRS is pretty clear about filing before receiving your W-2s: "Authorized IRS e-file Providers are prohibited from submitting electronic returns to the IRS prior to the receipt of all Forms W-2, W-2G, and 1099-R from the taxpayer."

The only time you can use information from pay stubs or a Leave and Earnings Statement (LES) is when the taxpayer is unable to secure an accurate W-2, W-2G, or 1099-R. In this case, the taxpayer needs to file a Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRA's Insurance Contracts, Etc. before filing their income tax return.

It Doesn't Speed Up Your Return

The IRS isn't even processing 2017 income tax returns yet. The filing season starts on 29 January 2018. Submitting your forms early does not necessarily get you your refund earlier.

Under federal law, refunds that includes the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) may not be issued until at least mid-February. At this time, the IRS is expecting to start issuing refunds including the EITC and ACTC on 27 February 2018.

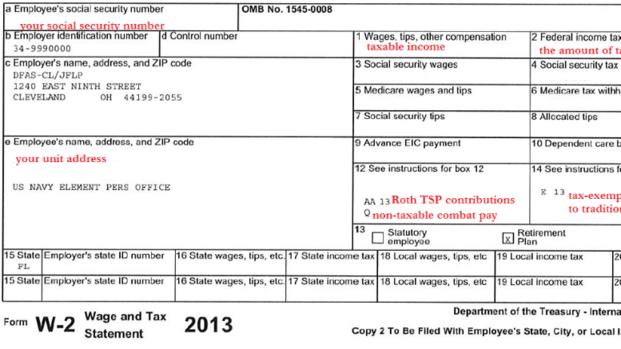

It Increases The Chances You'll Have To File Again

Military W-2s can be wrong the first time they are issued. If you rush to file your return quickly, and then get an amended W-2, you'll have to file an amended tax return. It's no big deal, but it is one extra step that can be avoided by just being patient in the first place.

Here are the online release dates for W-2s:

| Reserve Army, Navy, Air Force | 6 January 2018 |

| Marine Corps Active and Reserve | 11 January 2018 |

| Active Army, Navy, Air Force | 20 January 2018 |

I know it is hard to wait for your tax return when you have big plans for it, but rushing to file isn't going to speed up your refund. Waiting until you have physical W-2s is the first step in a smooth filing process.