The House Veterans Affairs Committee’s plan to pay for a bill to extend Agent Orange disability benefits to 90,000 Blue Water Navy veterans of the Vietnam War -- by raising funding fees under the VA guaranty home loan program -- will not continue to shield all disabled veterans from a funding fee, as the committee claimed last month as it cleared the bill for consideration of the full House.

The charge is made by “G2” Varrato II, a Phoenix realtor, Air Force retiree, and director of the Veterans Association for Real Estate Professionals (VAREP) for the state of Arizona. The committee does not dispute Varrato’s argument that veterans with disabilities rated below 100 percent would see their waiver of a VA loan funding fee disappear if they use their benefit on mortgages that exceed the Freddie Mac conforming loan limit, a program expansion the committee bill allows.

Every major veteran service organization publicly endorsed the committee’s amended version of the Blue Water Navy Vietnam Veterans Act (HR 299), which includes a new strategy to cover the bill’s $1 billion estimated cost for expanding Agent Orange-related benefits by charging slightly higher VA home loan funding fees and making other changes to the VA loan program.

It’s unclear now whether advocacy groups understood that certain disabled veterans, those with VA ratings below 100 percent, would be hit with their first VA home loan funding fees ever if were to take advantage of the jumbo loan feature.

The Freddie Mac conforming loan limit is set at $453,100 in most the country but varies by state or county depending on local housing markets. The conforming loan limit is near to $1 million in Hawaii and $800,00 in Ventura County, Calif.

Varrato said he only discovered last week how the House committee planned to finance HR 299 as he studied the bill in his role as national legislative committee chairman for VAREP, an organization that has pressed the Congress for five years to remove the conforming loan limit from the VA loan benefit program.

As a veteran, Varrato said, he is upset that the committee would remove the funding fee waiver for any disabled veteran, even if only for jumbo mortgages. He also believes, he said, that just a tweak to the bill might preserve the funding fee waiver for all disabled veterans, without putting the entire legislation at risk.

If the House committee isn’t prepared to change it, Varrato said, his organization will press senators to modify it during their work on a companion bill.

“I honestly didn’t start this to create hell, hate and discontent in the world,” Varrato told me. However, he said, he felt compelled to speak out when he read in this news column a comment last month from Rep. Phil Roe (R-Tenn.), chairman of the House committee, that no disabled veterans would be impacted by higher loan fees planned to help Blue Water Navy veterans.

Under current law, VA guarantees home loans by promising loan servicers that the government pay 25 percent of the loan if the veteran defaults. The guarantee allows veterans to get better loan terms, such as lower interest rates or smaller down payments. For this, VA charges the veteran a funding fee.

Currently, VA-backed loans can’t exceed the Freddie Mac conforming loan limit. If a veteran wants a bigger mortgage, say one that exceeds the loan limit by $100,000, then the veteran has to make his or her own 25 percent down payment on that portion of the loan VA doesn’t guarantee. Otherwise the veteran would have to buy mortgage insurance.

VA funding fees last were raised in 2004. Here’s how the House committee bill would raise them:

- From 2.15 percent to 2.40 percent of the loan amount for loans with no down payment and first use of the VA guarantee benefit;

- From 3.3 percent to 3.8 percent of the loan amount for loans with no down payment on subsequent use of the loan benefit;

- From 1.50 percent to 1.75 percent of the loan amount for loans with a 5 percent down payment and

- From 1.25 percent to 1.45 percent of the loan amount for loans with a 10 percent down payment.

The increases would take effect Jan. 1 next year and return to current levels after Sept. 30, 2026. Veterans with disabilities, about 47 percent of VA loan users, are exempt from funding fees.

The House bill also would permanently eliminate an additional 0.25 percent fee on the loan amount that current members of reserve components are charged for using their home loan benefit.

The funding fee changes are reasonable, Varrato said. He also lauded the bill because it would remove the conforming loan limit, as realtors have urged.

If veterans want to buy more expensive homes and can qualify for bigger mortgages, after the House bill becomes law VA would guarantee larger loan amounts. That would mean veterans no longer would have to put 25 percent down on portions of the loan in excess of the Freddie Mac limit.

But for these jumbo loans, the House bill would continue to waive the funding fees only for veterans rated 100 percent disabled. Those with disabilities rated 90 percent or less would, for the first time, have to pay the funding fee.

Varrato, who has a 60-percent VA disability rating, said in Phoenix where he sells homes, the conforming loan limit is $453,100. Under the House bill, most disabled veterans seeking a mortgage larger than that, assuming no money down, would face a funding fee for first time benefit use of 2.4 percent. On a loan of $454,000, for example, that be $10,896. On the same size loan with a higher “subsequent use” funding fee, of 3.8 percent, the disabled vet would pay a fee of $17,252.

Architects of the bill might have calculated that if a disabled vet can afford a jumbo loan, he or she also can afford to pay a funding fee, and perhaps should do so as long as they are not 100-percent disabled, I suggested to Varrato.

“They probably are telegraphing that,” he said. “But here’s something else to consider because we know how things work in Washington. If we permit erosion of this waiver on loans at or above that Freddie Mac ceiling, it’s an open door for Congress to later make the same argument for loans under the conforming limit and cast upon those not 100-percent disabled the same fee requirement.”

Another point to consider, he added, is that some disabled veterans who can afford jumbo loans might have lost a limb or two fighting for their country and still not be rated 100 percent disabled.

“In essence we’re going to say ‘Sorry that you were in Iraq, driving your Humvee, got blown up and lost a leg. But you’re not as worthy of receiving that waiver as a guy injured in a more severe way.’”

In scoring the House bill, Varrato noted, the Congressional Budget Office found that not only would higher VA loan fees cover the cost of expanding Agent benefits to Blue Water Navy veterans, it would produce a $271 million VA budget gain. That should be used, he said, to amend the bill to preserve the funding fee waiver for every disabled veteran, regardless of the size of their mortgage.

To comment, write Military Update, P.O. Box 231111, Centreville, VA, 20120 or email milupdate@aol.com or twitter: @Military_Update.

|

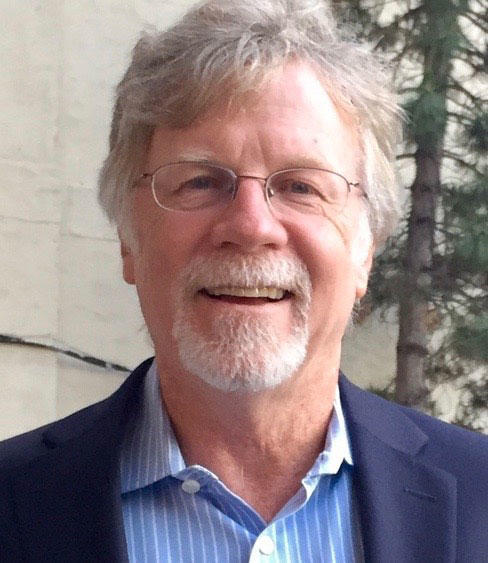

Tom Philpott has been breaking news for and about military people since 1977. After service in the Coast Guard, and 17 years as a reporter and senior editor with Army Times Publishing Company, Tom launched "Military Update," his syndicated weekly news column, in 1994. "Military Update" features timely news and analysis on issues affecting active duty members, reservists, retirees and their families. Tom's freelance articles have appeared in numerous magazines including The New Yorker, Reader's Digest and Washingtonian. |

|

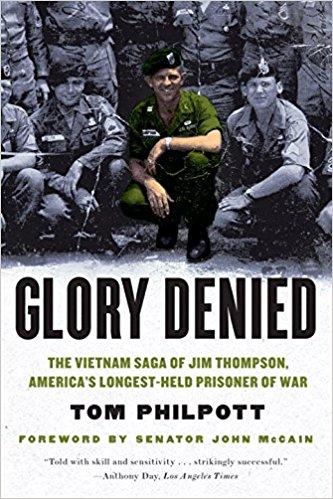

His critically-acclaimed book, Glory Denied, on the extraordinary ordeal and heroism of Col. Floyd "Jim" Thompson, the longest-held prisoner of war in American history, is available in hardcover and paperback on Amazon. |