For years, we’ve been on a quest to find the best budgeting app.

You see, budgeting is an essential foundation of personal finance, so it’s a journey you can’t take lightly.

But while there are great apps available to manage your overall finances, finding one to make a budget has proved to be much more difficult.

Let’s rephrase that: Finding a budgeting app that meets your needs — and is affordable — has proved difficult.

What if you don’t need a financial adviser, a bill cutter, a money-making app or recommendations for the best credit cards? What if your specific needs are just figuring out how to budget, track your spending and check in on your progress?

We traveled far and wide through the internet and app stores to find one budgeting app to rule them all. A budgeting app that lets you adjust your income and expenses, and sync your transactions in real time.

How to Determine the Best Budgeting App for You

There are several things to consider when you’re looking for a good budgeting app for you.

- The flexibility to customize based on how you get income and what kind of budget you’re using.

- The extent to which you want your accounts synced. Do you prefer to manually track transactions, or do you want real-time transaction tracking for a few or all of your bank accounts?

- User experience. Are you OK with ads? Credit card offers?

- Cost. What do you get for free? How much do premium versions cost? What’s included if you pay for premium features?

We were searching for an easy-to-use, widely customizable app that could sync with your credit cards and checking account, at the very least. Ideally, it would be free, but we were willing to consider paid apps as well.

The 8 Best Budgeting Apps We Found

We tested the most popular, searched for and talked about apps in iTunes along with some that just looked super interesting.

Here’s how they stacked up against one another:

Honeyfi: The Overall Winner

Price: Free

Available on: Apple and Android

Syncs with accounts? Yes

Honeyfi is technically a budgeting app for couples, but single people shouldn’t write it off. You can easily add two of your emails and be your own domestic partner.

Honeyfi has no web-based budgeting option, but the capabilities of the app more than make up for it.

When you open it, your budget is the first box displayed, followed by your transactions. Once you link your accounts, Honeyfi will automatically make a budget for you based on your past spending. You can easily change it by clicking on the header.

You can have as many categories and subcategories as you want, and you can even create your own. The app automatically identifies recurring bills, but you can also manage them manually.

If you have a partner, you can communicate about transactions within the app and limit what transactions your partner can see.

Final verdict: If you have a joint account with your partner, HoneyFi is a no-brainer. You can customize your budget based on whatever budgeting method you prefer and sync all your bank accounts at the most affordable price: free.

We think it’s the best app on our list. And no, they didn’t pay anyone at The Penny Hoarder to say that.

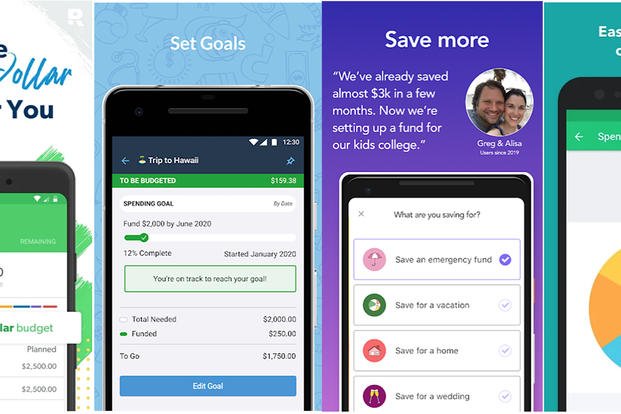

EveryDollar: Best User Experience

Price: Free for manual tracking; $99 per year for automatic syncing.

Available on: Apple and Android

Syncs with accounts? Only on the paid version

EveryDollar is a budgeting app created by Dave Ramsey. It’s made for zero-based budgets, a budgeting system where you make a plan for every dollar you bring in. Still, it works flawlessly with any kind of budget you want to set up. It has a clean and easy-to-navigate user experience that isn’t cluttered by ads or affiliate offers.

It’s available on Apple and Android app stores, and on desktop for those who like to budget on a big screen.

The downside for anyone looking to link their bank accounts is the annual fee. Its premium version, EveryDollar Plus, is a steep $99 per year. And there aren’t any additional benefits for a Plus account — just transaction syncing.

Final verdict: It’s best for zero-based budgeting, though it can easily work with any type of budget. But $99 a year for automatic transaction syncing? Sorry, but we can buy 14 burritos at Chipotle for that.

Mint: Best App for People Who Want Extras

Price: Free

Available on: Apple and Android

Syncs with accounts? Yes

Let’s continue with the most well-known on our list: Intuit’s Mint. It has no paid version, so you won’t have to deal with the limits other free apps impose. In return, you’ll have to deal with a plethora of ads and offers.

Transactions are easy to see. You can sync as many financial accounts as you want and make as many budgets as you want. (Most apps treat each budget category as separate “budgets.”) Mint can even predict your bills based on past expenses and tell you what it thinks will be due soon.

It’s easy to make a zero-based budget through the app, because you can change values based on what you anticipate making.

What I don’t love is all the fluff. Offering your credit score is nice, but the number of ads and offers make the app feel cluttered. You have to scroll down to find your budget on the home page.

Final verdict: If you’re looking for a free app that allows for customizing your budget and bank syncing, Mint is a great app. If you want one that’s just a budgeting tool with a simple user interface, you can do better.

You Need a Budget: Best App for Personal Finance Junkies

Price: Free for 34 days, then $6.99 per month

Available on: Apple and Android

Syncs with accounts? Yes

You Need a Budget, or YNAB for short, is one of the only apps without a free version, and it can be a little pricy for what it offers.

What makes YNAB so popular is that it’s not just a budgeting app. It’s a full-fledged system for your personal finances.

YNAB works best if you:

- Use a zero-based budget.

- Budgeting at least a month ahead.

- Are prioritizing paying off debt.

The app has some great premium features, though. It doesn’t just sync your checking accounts, but also your investments, and its algorithm helps you identify areas of overspending and how to adjust them. The app also makes budgeting recommendations based on your goals.

Final verdict: It’s got a lot of great features that focus solely on budgeting. But given that it’s only appropriate for one type of budget (zero-based), $83.88 per year is too much.

Mvelopes: Best App for Envelopes Fans

Price: Free 30-day trial, $39.99 per year

Available on: Apple and Android

Syncs with accounts? Yes

It doesn’t have a free version, but Mvelopes does have a free 30-day trial. And given its popularity, we thought this list would be lacking without it.

What we liked about Mvelopes was the ability to access it by laptop. But the Mvelopes desktop interface looks like it came straight out of Windows 2000.

One cool feature is “sweeping envelopes.” At the end of the month, if you have cash left over in an envelope, you can “sweep it” to your savings account, debt payoff or investment account envelope.

What we don’t like is that after you sync your bank accounts, neither the web version nor the app will upload my previous transactions. If you want to start from scratch, this is fine. But if you’re trying to start a budget mid-month? Not so good.

The basic version of Mvelopes is $4 per month, or $40 if you pay for a year upfront. There are two higher tiers: For $190 per year, you get debt-reduction tools and a quarterly meeting with a personal finance coach. For $590 per year, you’ll get those meetings monthly.

Final verdict: By the name, you can guess it’s best for envelope users, but you can use any type of budget beyond that. Unfortunately, it has some of the same bank syncing limitations as the free apps — but you pay for it.

GoodBudget: Best for People Who Still Use Cash

Price: Free version or $50 per year

Available on: Apple and Android

Syncs with accounts? Technically…

Where GoodBudget excels is helping people use the envelope system, Dave Ramsey’s preferred method for paying off debt.

It has some features EveryDollar doesn’t. For example, it lets you roll over any unused cash to the next month’s envelope, and it reports on your spending by envelope or month.

The biggest downside is that it doesn’t sync your transactions. Not even with the paid version. It connects with your bank account but only keeps your account balance up to date. You then have to upload your transaction history or manually input transactions.

Final verdict: It’s great if you’re committed to a cash-spending system… not so much if you use cards. You can customize it based on your budget, but with no option for bank syncing, we can’t see a reason to choose this app.

PocketGuard: Best for People Who Want a Personalized Budget

Price: Free version or $34.99

Available on: Apple and Android

Syncs with accounts? Yes

You can do a lot with the free version of PocketGuard. So much, in fact, that I don’t really see the need for the paid version unless you want very specific budget categories.

Instead of “budgets,” PocketGuard uses “spending limits.” You can have a limit for every budget category, or “pocket.” The app will automatically build a personalized budget for you based on your income, bills and goals.

Overall, the app and website are really nice. You can make a monthly savings goal, mark bills as recurring and see how much you have in your “pocket” for the day, week or month. You’ll have to play around with it to make sure PocketGuard is sorting everything right, but once you do that, it’s very hands-off.

The downfall to PocketGuard might be it’s In My Pocket feature. I get paid on the last day of the month, but my mortgage comes out on the first. So even though I had money in the bank, PocketGuard had me starting the month in the hole until I got more income. I wouldn’t use this feature, but I’d use everything else.

Final verdict: It offers affordable transaction syncing, but we don’t know what budgeting method you’d use for PocketGuard. It’s a good accompaniment, but we wouldn’t use it as a sole budgeting app.

Wally: Best for Group Budgeting

Price: Free with paid add-ons

Available on: Apple and Android

Syncs with accounts? Not on the free version

Wally is a budgeting app with a few iterations.

When searching for the app, you’ll come across Wally+, the Android version, Wally Next, and Wally Lite, the Apple versions. I still can’t tell you what the difference is, but Wally Next seems to be the one that developers are updating for iPhone, so we’ll review that one.

PRO TIP: Groups can also use Wally to track expenses, making it useful for budgets outside of your personal one.

Unless you pay for the add-on, you’ll have to manually track your transactions. But it has this neat feature that uses geolocation to figure out where each transaction you enter was made.

It saves the location, which makes updating a breeze if you frequent the same locations.

You can buy individual add-ons for less than 50 cents per year. You can get all the add-ons, including transaction syncing, for life for $34.99. It’s a great price compared to other apps with annual membership.

Final verdict: There’s flexibility for budgeting methods, categories and affordable transaction syncing. But where Wally really shines is for anyone dealing in foreign currency, event planning budgets or any budget that multiple people work on.

Whatever budgeting tool you choose, congrats on taking this important step to get your personal finances in order and put more money in your pocket.

Feeling overwhelmed? Create a budget that works for you with our budgeting bootcamp!

This article was originally published by The Penny Hoarder.

Keep Up with the Ins and Outs of Military Life

For the latest military news and tips on military family benefits and more, subscribe to Military.com and have the information you need delivered directly to your inbox.